IL ST-556 (1) Instructions 2023-2024 free printable template

Show details

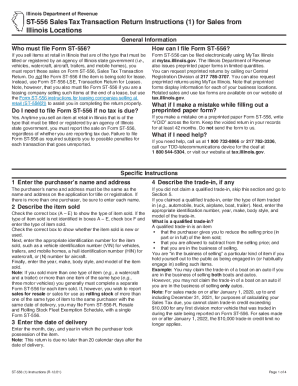

Do I need to file Form ST 556 if no tax is due Yes. Anytime you sell an item at retail in Illinois that is of the type that must be titled or registered by an agency of Illinois state government you must report the sale on Form ST 556 regardless of whether you are reporting tax due. Failure to file Form ST-556 as required subjects you to possible penalties for each transaction that goes unreported. How can I file Form ST-556 Form ST-556 must be filed electronically if your annual gross...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your st 556 2023-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 556 2023-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 556 online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit illinois st 556 pdf form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it now!

IL ST-556 (1) Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st 556 2023-2024 form

How to fill out st 556 form

01

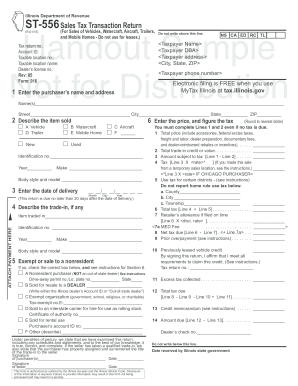

To fill out st-556 sales tax transaction, follow these steps:

02

Start by entering your business name and address at the top of the form.

03

Next, provide the buyer's name and address in the designated section.

04

Fill in the date of the transaction and the amount of the sale.

05

Specify the type of merchandise or service being sold.

06

Indicate the tax rate applicable to the transaction.

07

Calculate and enter the total amount of tax due.

08

Finally, sign and date the form to certify its accuracy.

Who needs st 556 form?

01

Anyone who sells taxable goods or services in the state of Illinois needs to fill out st-556 sales tax transaction. This includes businesses and individuals engaging in retail or wholesale activities subject to sales tax.

Video instructions and help with filling out and completing st 556

Instructions and Help about il st 556 form

Fill st 556 instructions : Try Risk Free

People Also Ask about st 556

Are sales taxes collected from customers and remitted to the state by seller?

What is the sales tax remittance threshold in Illinois?

What is Illinois Form ST 556 for?

How do I remit sales tax in Illinois?

Is Illinois sales tax accrual or cash?

What is ST 556 form for Illinois?

What is an st1 form Illinois?

How do I file local sales tax in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is st-556 sales tax transaction?

The st-556 sales tax transaction is a form used to report sales and use tax in the state of Illinois.

Who is required to file st-556 sales tax transaction?

Businesses who make sales subject to sales tax in Illinois are required to file the st-556 sales tax transaction form.

How to fill out st-556 sales tax transaction?

To fill out the st-556 sales tax transaction form, businesses need to provide information about their sales transactions, including the amount of sales, the tax collected, and other relevant information.

What is the purpose of st-556 sales tax transaction?

The purpose of the st-556 sales tax transaction form is to report sales and use tax information to the state of Illinois for tax compliance purposes.

What information must be reported on st-556 sales tax transaction?

The st-556 sales tax transaction form requires businesses to report information such as the amount of sales, the tax collected, and any exemptions or deductions applied.

When is the deadline to file st-556 sales tax transaction in 2023?

The deadline to file the st-556 sales tax transaction in 2023 is typically the 20th day of the month following the reporting period.

What is the penalty for the late filing of st-556 sales tax transaction?

The penalty for the late filing of the st-556 sales tax transaction can vary, but it typically includes a percentage of the unpaid tax due for each month the form is late, up to a maximum penalty percentage.

How can I get st 556?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific illinois st 556 pdf form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit st 556 form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your illinois st 556 form printable, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete st 556 form illinois on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your st 556 form download. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your st 556 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 556 Form is not the form you're looking for?Search for another form here.

Keywords relevant to illinois st 556 form

Related to what is st556 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.